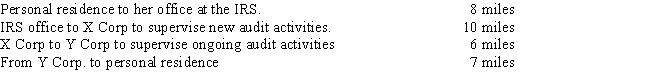

Donna is an audit supervisor with the IRS and on January 4,2016 she uses her car in the following manner.

What amount of Donna's mileage for this day is qualified business mileage?

Definitions:

Adjusting Entry

A journal entry made at the end of an accounting period to allocate income and expenditures to the appropriate period, ensuring that revenues and expenses are matched.

Short-Term Investments

Investments that are expected to be converted into cash, sold, or consumed within a year or within one business cycle, whichever is longer.

Converted Into Cash

Refers to the process of liquidating assets or investments to generate cash flow.

Significant Influence

The power to participate in the financial and operating policy decisions of an investee without having control over those policies.

Q21: Capital loss<br>A)Limited to $3,000 annually for individuals.<br>B)When

Q41: Gary,a sole proprietor,incurs the following expenses in

Q45: Ellie,age 12,earns wages of $4,300 from her

Q64: Determine the proper classification(s)of the asset discussed

Q67: In which of the following circumstances will

Q72: Michael,age 42 and single,has a 13-year-old son,Tony.Tony

Q101: John purchases all of the common stock

Q122: Carmen purchased a business for $150,000 by

Q131: Health Savings Accounts are available only to

Q146: For each of the following situations,determine whether