During 2016,Marsha,an employee of G&H CPA firm,drove her car 24,000 miles.The detail of the mileage is as follows:

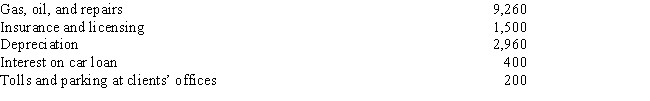

Marsha's 2016 records show that her car expenses totaled $14,320.The details of the expenses are as follows:

What is the amount of her deduction for her use of the car?

Definitions:

U.S. Constitution

The supreme law of the United States, establishing the framework of the national government and the rights of the citizens.

Inconsistent State Laws

Statutes or regulations enacted by individual states that are at odds with federal laws or the laws of other states, potentially leading to legal conflicts.

Reformation

An equitable remedy in which a court effectively rewrites the terms of a contract.

Contract Terms

The conditions and clauses that form the content of a contract, defining the obligations, rights, and duties of each party.

Q12: Any corporate capital loss not used in

Q16: Safina,a single taxpayer with adjusted gross income

Q27: Investment interest<br>A)Prepaid interest.<br>B)An amount that each taxpayer

Q68: Several factors are used to determine whether

Q72: Ira sells two of his personal automobiles,a

Q112: Small business stock<br>A)A loss that is generally

Q112: Which of the following can be deducted

Q118: Travel and lodging expense of $800 incurred

Q122: Concerning the credit for child and dependent

Q165: Which of the following is an example