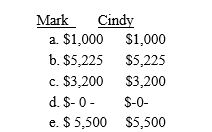

Mark and Cindy are married with salaries of $45,000 and $42,000,respectively.Adjusted gross income on their jointly filed tax return is $98,000.Both individuals are active participants in employer provided qualified pension plans.What is the maximum amount each person may deduct for AGI with regard to IRA contributions?

Definitions:

Table

A structured arrangement of data made up of rows and columns, which is used to organize information in a clear and concise manner.

Clearance Price

A significantly reduced price aimed at quickly selling off product inventory, often to make space for new stock.

Data Type

A classification identifying the type of data that a variable or object can hold in programming, such as integer, string, or boolean.

Field

In computing, a field is a data storage space for a particular piece of information within a record in a database or a form.

Q2: Cornell is a building contractor who builds

Q4: Pedro owns a 50% interest in a

Q12: Lilly and her husband Ben have a

Q30: Salvador owns a passive activity that has

Q62: On December 24 of the current year,Louise

Q67: On her 18th birthday,Patti's grandfather gave her

Q81: For purposes of the relationship test for

Q84: Reggie and Ramona are married and have

Q107: For each of the following situations,determine whether

Q136: Dan is the owner of VHS Video's