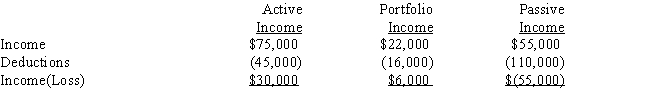

A taxpayer had the following for the current year:

I.If the taxpayer is a closely held corporation,taxable income from the three activities is income of $6,000.

II.If the taxpayer is an individual and the passive income is not related to a rental real estate activity,taxable income is $36,000.

Definitions:

Perception

The process of interpreting and understanding sensory information from the environment.

Stimuli

External or internal changes that influence the behavior or responses of an organism.

Specialized Cells

Cells differentiated to perform specific functions in an organism, such as muscle cells for movement.

Receptors

Specialized cells or protein molecules in the body that receive and respond to chemical signals, such as neurotransmitters or hormones.

Q3: Felix purchases the franchise rights to a

Q10: Dana purchases an automobile for personal use

Q16: Robbie is 18,and a dependent on his

Q38: MACRS<br>A)The depreciation method for real estate.<br>B)A term

Q42: Angie's employer has a qualified pension plan.The

Q45: All of the following are capital assets,except<br>A)Personal

Q57: Systech offered its stockholders a choice between

Q71: Items that are excluded from gross income

Q85: Makemore Company purchases a factory for $800,000.The

Q158: Sheila extensively buys and sells securities.The IRS