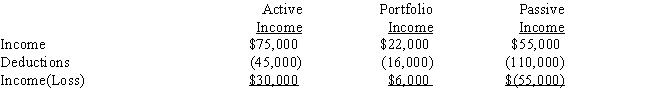

If a taxpayer has the following for the current year:

I.If the taxpayer is a regular corporation,taxable income from the three activities is a loss of $19,000.

II.If the taxpayer is an individual and the passive income is related to a rental real estate activity in which the taxpayer is an active participant,taxable income is $11,000.

Definitions:

Scientific Process

A methodological approach to inquiry involving systematic observation, experimentation, and analysis to gain knowledge and understand phenomena.

Numerical Ratings

Quantitative scores assigned to evaluate performance, satisfaction, or other measurable aspects, facilitating comparison and analysis.

Hypotheses

Proposed explanations made on the basis of limited evidence as starting points for further investigation.

Scientific Process

A methodical approach used in scientific research to generate empirical evidence and validate hypotheses through observation, experimentation, and analysis.

Q29: Why might a taxpayer elect to depreciate

Q50: Shannon is 16 years old and is

Q58: Business meals<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited to $25

Q59: In 2016,Steve purchases $975,000 of equipment.The taxable

Q77: Which of the following expenses is/are deductible?<br>I.Transportation

Q93: Bowen is planning to quit his job

Q114: Morgan,a banker,is an amateur photographer who takes

Q123: Explain why the taxpayer in each of

Q132: Mr.and Mrs.Bachman,both age 65,file a joint return.In

Q147: During the current year,Eleanor receives land valued