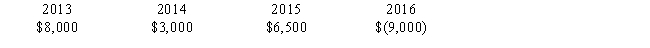

Billingsworth Corporation has the following net capital gains and losses for 2013 through 2016.Billingsworth' marginal tax rate is 34% for all years.

In 2016,Billingsworth Corporation earned net operating income of $30,000.What is/are the tax effect(s) of the $9,000 net capital loss in 2016?

I.Corporate taxable income is $21,000.

II.The net capital loss will provide income tax refunds totaling $3,060.

Definitions:

Voluntary Grasping

An intentional act of seizing or holding onto an object using the hands or fingers, often seen as a developmental milestone in infants.

Brazelton Neonatal Behavioral Assessment Scale

A measure of a newborn’s motor behavior, response to stress, adaptive behavior, and control over physiological state.

Adaptive Behavior

The collection of conceptual, social, and practical skills that people have learned to be able to function in their everyday lives.

Parent-Infant Bonding

The process of developing a close, emotional connection between a parent and their newborn, crucial for the infant's social and emotional development.

Q29: On May 1,2016,Linda sells her rental property

Q60: Electronic City sells various electronic products.With each

Q61: Which of the following individuals or couples

Q62: Due to a shortage of cash,East Coast

Q70: Which of the following is not a

Q77: Travis inherits $50,000 from his grandfather.He receives

Q96: Which of the following is not a

Q129: Victor bought 100 shares of stock of

Q146: For each of the following situations,determine whether

Q159: David,an employee of Lima Corporation,is a U.S.citizen