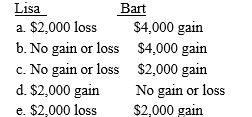

Lisa sells some stock she purchased several years ago for $10,000 to her brother Bart for $8,000.One year later Bart sells the stock for $12,000.The tax consequences to Lisa and Bart are:

Definitions:

Contagious

Can be spread from one individual to another through either direct or indirect means of contact.

Pigment

Substances that give color to materials and biological tissues, used in painting, manufacturing, and various biological functions.

Sweat Glands

Specialized glands in the skin that produce sweat as part of the body's mechanism for regulating temperature.

Q15: Head of household<br>A)Unmarried without dependents.<br>B)Generally used when

Q25: Capital gain and loss planning strategies include<br>I.the

Q45: Determine the adjusted basis of the following

Q47: Sammy buys a 20% interest in Duvall

Q53: To be a qualifying relative,an individual must

Q59: The wash sale provisions apply to which

Q61: Sadie is a full time nurse and

Q96: Scholarship<br>A)Dues, uniforms, subscriptions.<br>B)Intended to punish and are

Q103: Married,filing separately<br>A)Unmarried without dependents.<br>B)Generally used when financial

Q132: Income tax accounting methods and financial accounting