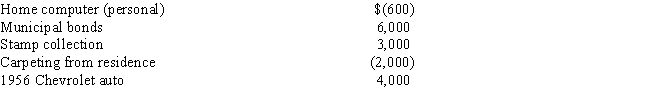

Samantha sells the following assets and realizes the following gains (losses) during the current year:

As a result of these sales,Samantha's adjusted gross income will:

Definitions:

Book Value

The difference between the total assets and total liabilities of a company, indicating its net asset value as recorded on the balance sheet.

Purchase

The acquisition of goods or services in exchange for money, signifying an increase in ownership of assets or services.

Sale

A sale is the transaction between two parties where the buyer receives goods, services, or assets in exchange for money or other consideration from the seller.

Equity Method

An accounting technique used for recording investments in which the investor has significant influence over the investee, typically between 20% and 50% ownership.

Q3: Felix purchases the franchise rights to a

Q9: De minimus fringe<br>A)An employee may exclude up

Q14: Which of the following expenses is not

Q31: Alternate valuation date<br>A)Begins on the day after

Q33: Employee discount<br>A)Dues, uniforms, subscriptions.<br>B)Intended to punish and

Q70: Lindale Rentals places an apartment building in

Q74: The general rule for determining the basis

Q87: Summary Problem: Tommy,a single taxpayer with no

Q125: Eric,who is 18 years old,sells magazine subscriptions

Q129: For each of the following situations explain