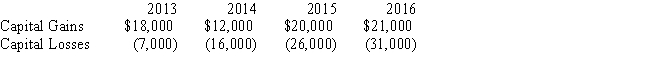

The Corinth Corporation is incorporated in 2013 and had no capital asset transactions during the year.From 2013 through 2016,the company had the following capital gains and losses:

If Corinth's marginal tax rate during each of these years is 34%,what is the effect of Corinth's capital gains and losses on the amount of tax due each year?

Definitions:

Action Potential

A rapid, temporary change in the electrical potential across a cell membrane, leading to the transmission of nerve impulses.

Single Active Neuron

describes a scenario where only one neuron is actively firing, often used in neurological studies to understand neuronal behavior.

Action Potentials

Rapid, short-duration electrical impulses in a neuron or muscle cell, which allow for the transmission of information and signals.

Na⁺ Ions

Sodium ions, which are essential for various physiological processes including nerve impulse conduction and muscle contraction.

Q1: Direct purchase<br>A)Begins on the day after acquisition

Q3: Isabel,age 51 and single,is an electrical engineer

Q11: For each of the following situations,determine whether

Q12: Any corporate capital loss not used in

Q30: Moran pays the following expenses during the

Q74: Christy purchases $1,000-worth of supplies from a

Q75: Home equity loan interest<br>A)Prepaid interest.<br>B)An amount that

Q95: On February 3 of the current year,Samantha

Q112: Phi Corporation had the following capital gains

Q151: Generally income tax accounting methods are designed