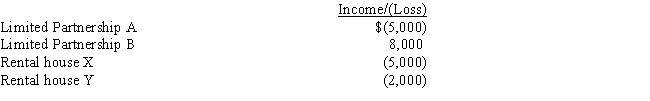

Judy and Larry are married and their combined salaries for the current year are $115,000.They actively participate in the rental of two houses.For the current year they have the following losses:

What is Judy and Larry's adjusted gross income?

Definitions:

Janitorial Department

The division within an organization responsible for maintaining the cleanliness and hygiene of the premises.

Sequential Method

A process or technique that follows a specific order or sequence, often used in operations or calculations.

Janitorial Department

A department within an organization responsible for maintaining cleanliness, hygiene, and sanitation within the premises.

Square Footage

The area of space measured in square feet, commonly used in real estate to describe the size of a building or room.

Q31: The Section 179 election promotes which of

Q37: Explain the non-support test and the principle

Q54: Winslow owns a residential rental property with

Q54: What is the MACRS recovery period for

Q56: The exclusion of a percentage of the

Q58: Business meals<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited to $25

Q70: Active participant<br>A)A loss that is generally not

Q90: Orrill is single and has custody of

Q131: During 2015,Virginia,an architect,made a bona fide $7,500

Q135: LeRoy has the following capital gains and