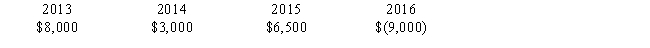

Billingsworth Corporation has the following net capital gains and losses for 2013 through 2016.Billingsworth' marginal tax rate is 34% for all years.

In 2016,Billingsworth Corporation earned net operating income of $30,000.What is/are the tax effect(s) of the $9,000 net capital loss in 2016?

I.Corporate taxable income is $21,000.

II.The net capital loss will provide income tax refunds totaling $3,060.

Definitions:

IPIP

The International Personality Item Pool, which is a public domain collection of items for the assessment of personality traits.

Continuum

A continuous sequence, range, or whole in which no part or division is noticeably different or distinct from adjacent parts.

Personality Questionnaire

A survey designed to evaluate aspects of an individual's character, preferences, and psychological traits.

Morality

Principles concerning the distinction between right and wrong or good and bad behavior.

Q6: Primary valuation date<br>A)Begins on the day after

Q32: In September 2016,Eduardo sells stock he purchased

Q32: Virginia,a practicing CPA,receives $11,000 from the sale

Q74: Lynnette is a single individual who receives

Q75: Discuss why listed property gets special attention.

Q81: Tory sells General Electric stock (owned 10

Q90: In July 2016,Harriet sells a stamp from

Q94: Buffey operates a delivery service.She purchased a

Q115: Material participation requires that an individual participates

Q126: During 2016,Marla earns $2,700 from a summer