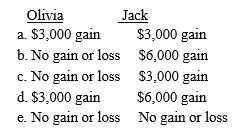

Olivia sells some stock she purchased several years ago for $9,000 to her brother Jack for $12,000.One year later Jack sells the stock for $15,000.The tax consequences to Olivia and Jack are:

Definitions:

Consolidated Statement

A financial statement that aggregates the financial position and operations of a parent company and its subsidiaries, presenting them as a single economic entity.

Income Tax Calculations

The process of determining the tax payable to the government based on earned income, after allowances and deductions are applied.

Outstanding Common Shares

Refers to the total number of shares of a corporation that are currently owned by all its shareholders, including share blocks held by institutional investors and restricted shares.

Deferred Income Tax

Income tax obligations that a company has accrued but not yet paid, appearing on the balance sheet as a liability.

Q3: Isabel,age 51 and single,is an electrical engineer

Q22: Melissa owns 40,000 shares of Wilkerson Corporation

Q24: Loren owns three passive activities that had

Q37: Tom,Dick,and Harry operate Quality Stores.Based on advice

Q51: To qualify as a qualifying child,an individual

Q58: Business meals<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited to $25

Q87: Kenneth owns all of the stock of

Q120: Gross selling price includes<br>I.the amount of a

Q134: Karen owns a vacation home in Door

Q149: During the Chili Company Christmas party,Alex is