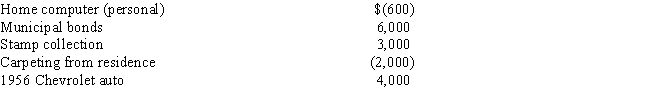

Samantha sells the following assets and realizes the following gains (losses) during the current year:

As a result of these sales,Samantha's adjusted gross income will:

Definitions:

Neurofibrillary Tangles

Aggregates of hyperphosphorylated tau protein that are most commonly known as a primary marker of Alzheimer's disease.

Plaques

Deposits of fatty substances, cholesterol, cellular waste products, calcium, and fibrin in the inner lining of an artery which can lead to atherosclerosis and other cardiovascular diseases.

Dementia

A state of mental deterioration characterized by impaired memory and intellect and by altered personality and behavior.

Pulmonary Embolism

A blockage in one of the pulmonary arteries in the lungs, typically caused by blood clots that travel from the legs or other parts of the body.

Q9: Cost recoverable intangible properties include<br>I.Uranium ore.<br>II.Patents.<br>III.Agreements not

Q28: Income tax accounting methods and financial accounting

Q30: Moran pays the following expenses during the

Q46: Gus owes $50,000 in credit card debt

Q47: Corky receives a gift of property from

Q52: Leon is allowed to deduct all the

Q63: In April of the current year,Speedy Printing

Q70: Active participant<br>A)A loss that is generally not

Q76: Wanda owns and operates a restaurant on

Q88: Michelle's employer pays for her graduate school