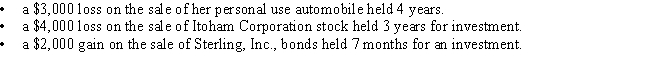

During the current year,Cathy realizes  Determine the tax consequences of these events.

Determine the tax consequences of these events.

Definitions:

Single Entity

A business or organization that is legally recognized as a single unit, distinct from its owners or shareholders.

Exporting

The act of sending goods or services to another country for sale.

Foreign Markets

Markets outside the domestic borders where companies can expand their operations and sales.

Q2: Limited partnership<br>A)A loss that is generally not

Q16: Cheryl purchased 500 shares of Qualified Small

Q27: Jolie purchased her residence in 2010 for

Q36: Virginia owns a business that rents power

Q47: Capital expenditure<br>A)Automobile used 75% for business.<br>B)Investment expenses

Q53: Manu bought Franklin's ownership interest in Antoine

Q56: Which of the following is/are currently deductible

Q78: Sybil purchased 500 shares of Qualified Small

Q92: Which of the following is/are adjustment(s)to the

Q119: Gains on the sale of certain types