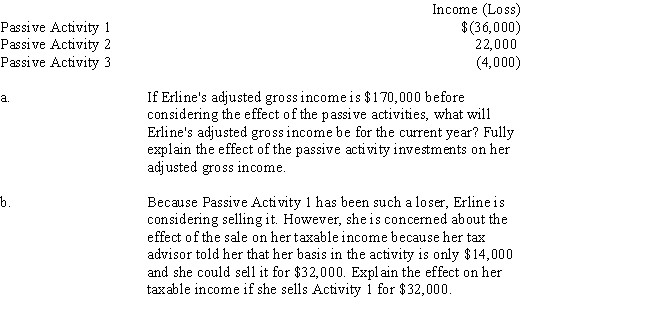

Erline begins investing in various activities during the current year.Unfortunately,her tax advisor fails to warn her about the passive loss rules.The results of the three passive activities she purchased for the current year are:

Definitions:

Breathing

The process of inhaling and exhaling air to facilitate gas exchange with the internal environment, primarily by bringing in oxygen and flushing out carbon dioxide.

Blood Flow

The continuous movement of blood through the circulatory system, delivering nutrients and oxygen to, and removing waste products from, tissues and organs.

Magnetic Resonance Imaging

A non-invasive imaging technique that uses strong magnetic fields and radio waves to generate detailed images of the inside of the body, especially useful for soft tissues.

Positron Emission Tomography

A medical imaging technique that uses radioactive tracers to visualize and measure changes in metabolic processes.

Q2: The American Opportunity Scholarship Tax Credit provides

Q8: Brent purchases a new warehouse building on

Q8: Long-term capital gain classification is advantageous to

Q21: Disability payment<br>A)Dues, uniforms, subscriptions.<br>B)Intended to punish and

Q41: Residential rental real estate placed in service

Q49: Determine the proper classification(s)of a house owned

Q51: Hank's employer gives him fishing gear that

Q70: If a taxpayer owes interest,economic performance occurs<br>I.with

Q106: Which of the following must be classified

Q133: Political contributions<br>A)Capitalized and amortized over a number