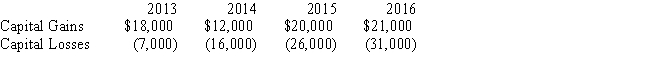

The Corinth Corporation is incorporated in 2013 and had no capital asset transactions during the year.From 2013 through 2016,the company had the following capital gains and losses:

If Corinth's marginal tax rate during each of these years is 34%,what is the effect of Corinth's capital gains and losses on the amount of tax due each year?

Definitions:

Protein

Large molecules composed of amino acids that perform a vast array of functions in the body, including catalyzing metabolic reactions, DNA replication, and responding to stimuli.

Kidney Damage

Kidney damage refers to physical, chemical, or biological changes to the kidneys that impair their function, potentially leading to renal disease or failure.

Urinary System

The organs of the body involved in the production, storage, and expulsion of urine.

Diuretic Drugs

Medications designed to increase the amount of water and salt expelled from the body as urine.

Q3: Safina is a high school teacher.She has

Q18: The Wilson Corporation incurs the following expenses.Explain

Q40: Marilyn sells 200 shares of General Motors

Q55: Rand Company purchases and places into service

Q83: Travis is a 30% owner of 3

Q102: Stan sells a piece of land he

Q103: Which of the following must be classified

Q105: The earlier the depreciation deduction can be

Q132: Income tax accounting methods and financial accounting

Q158: Sheila extensively buys and sells securities.The IRS