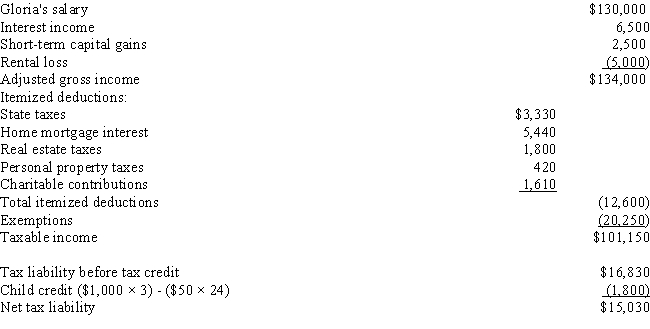

COMPREHENSIVE TAX CALCULATION PROBLEM.Girardo and Gloria are married with 3 children,ages 14,11,and 8.Gloria is a senior vice-president for a security firm and Girardo is a househusband who spends 15 hours a week doing volunteer work for local organizations.Girardo inherited $800,000 from his grandfather in 1999.He spends 10 hours a week managing the rental property they purchased with part of the inheritance and the family's stock portfolio.Prior to becoming a househusband,Girardo was an award winning high school accounting teacher.In February of 2016,Girardo is approached by the high school principal about returning to his former position.Girardo would receive an annual salary of $50,000.He is a little hesitant about accepting the offer,because he enjoys his volunteer work.Girardo's accountant has provided him with the following projection of their 2016 tax liability:

Girardo's projection from his accountant does not include his salary from teaching.Assume that Girardo's pro-rata salary for the year will be $30,000.Calculate Girardo and Gloria's tax liability,if Girardo decides to return to teaching.Also determine the marginal and effective tax rates on Girardo's salary.

Definitions:

Surgeon Negligence

A failure by a surgeon to meet the standard of care expected in their profession, often leading to harm or injury to the patient.

Tort Liability

Legal obligation arising from civil wrongs or injuries that do not arise from contractual obligations, resulting in damages or compensation awarded by a court.

Patient Liability

The financial responsibility borne by a patient for a portion of healthcare expenses not covered by insurance.

Professional Negligence

A breach of the duty of care by a professional towards a client or patient, leading to loss or harm due to a failure to meet standard professional practices.

Q4: Davidson Corporation has the following gains and

Q48: Hilliard receives a gift of stock from

Q49: Determine the proper classification(s)of a house owned

Q50: During the year,Aimee reports $30,000 of active

Q77: Dustin buys 200 shares of Monroe Corporation

Q80: "Active participation" and "real estate professional" are

Q87: Adjusted basis is equal to the initial

Q95: Section 1245 property<br>A)Stocks, bonds, options.<br>B)Depreciable real property.<br>C)All

Q99: Darlene and Joseph are married and have

Q100: A passive activity<br>I.includes any trade or business