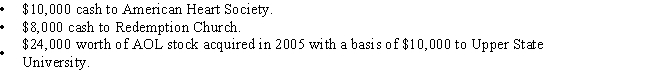

Armando has AGI of $80,000 and makes the following charitable contributions:

What is Armando's maximum charitable deduction in the current year?

Definitions:

Accrued Expense

An accounting term referring to expenses that have been incurred but not yet paid, representing liabilities on a company's balance sheet.

Income Taxes

Taxes levied by the government on income generated by businesses and individuals within their jurisdiction.

Accounting Period

A specific period of time used for financial reporting, typically a year or quarter, during which a company's financial performance is calculated.

Adjusting Entries

Accounting records created at the conclusion of an accounting cycle to distribute revenues and expenses to the period they truly belong.

Q37: Explain the non-support test and the principle

Q50: Which of the following is not deductible?<br>A)Expenses

Q56: Margie is single and is an employee

Q71: Capital recovery<br>A)The depreciation method for real estate.<br>B)A

Q76: Sara constructs a small storage shed for

Q80: Matt has a substantial portfolio of securities.As

Q87: Barney's sailboat is destroyed in an unusual

Q95: Perry owns all of the stock of

Q102: Which of the following taxpayers can claim

Q105: "Recapture of depreciation" refers to:<br>A)Downward adjustments of