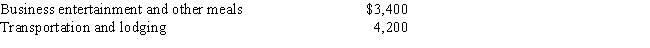

Toby,a single taxpayer with no dependents,is an employee of a large consulting firm.During the year he incurs the following business expenses that are not reimbursed by his employer:

Toby's AGI is $100,000 and is in the 28% marginal tax rate.In addition to the expenditures described above,his only other qualified itemized deductions are home mortgage interest of $6,000 and property taxes of $2,000.What is the after-tax cost to Toby of his unreimbursed employee business expenses?

Definitions:

Arteries

Blood vessels that carry oxygenated blood away from the heart to the body's tissues.

Aortic Arch

The curved portion of the aorta, the major artery coming from the heart, from which the main arteries of the head, neck, and upper limbs arise.

Brachiocephalic Trunk

A major artery in the upper body that supplies blood to the right arm, head, and neck.

Left Subclavian Artery

A major artery that supplies blood to the left arm, neck, and head, originating from the aortic arch.

Q1: Legal expenses are generally deductible if they

Q31: During the year,Shipra's apartment is burglarized and

Q43: The amount realized equals the gross selling

Q50: Which of the following is not deductible?<br>A)Expenses

Q58: Michelle is a bank president and a

Q72: Michael,age 42 and single,has a 13-year-old son,Tony.Tony

Q88: Nonresidential commercial realty placed in service on

Q133: Political contributions<br>A)Capitalized and amortized over a number

Q136: Walker,an employee of Lakeview Corporation,drives his automobile

Q142: Alex and Alicia are married and have