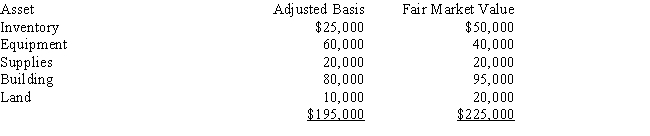

Nanci purchases all of the assets of Michael's Security Service for $200,000.The assets are as follows:

What is Nanci's basis in the equipment?

Definitions:

Set-Aside Program

Component of a government contract specifying that certain government contracts (or portions of those contracts) are restricted to small businesses and/or to women- or minority-owned companies.

Government Contracts

are agreements entered between companies and government entities for the provision of goods and services.

Qualifying Small Businesses

Refers to small businesses that meet specific criteria set by government or financial entities to be eligible for benefits or incentives.

Business Plan

A document that outlines a company's goals, the strategy to achieve them, financial forecasts, and market analysis.

Q11: Mountain View Development Co.purchases a new high

Q37: Tax home<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited to $25

Q44: The deferral of a gain realized on

Q54: Kiddie tax<br>A)Prepaid interest.<br>B)An amount that each taxpayer

Q69: George and Kelly have their three children

Q81: Margaret is single and is a self-employed

Q91: Which of the following business expenses is/are

Q104: Rosalee has the following capital gains and

Q125: Jennifer's business storage shed is damaged by

Q138: Sally and Kelly are both enrolled in