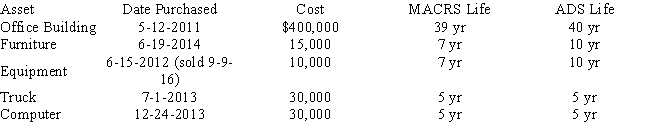

Kuo Corporation uses the following assets in its business in 2016:

Assume Kuo Corporation does not utilize Sec 179 expense,has not disposed of any asset since 2002,and has never expensed an asset previously.The equipment was sold on 9-9-16 for $4,000.

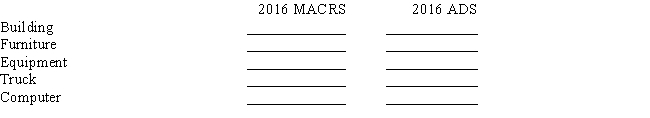

What is Kuo's 2016 depreciation expense using MACRS and for ADS?

Definitions:

Harm

Damage or injury that is done or sustained by someone or something.

Loss

A reduction in value or the act of losing something.

Damage

Physical harm that impairs the value, usefulness, or normal function of something.

Danger

The possibility of harm or adverse effects resulting from exposure to hazardous situations, substances, or activities.

Q5: Roger owns 65% of Silver Trucking,a partnership.During

Q6: Office building for office equipment.<br>A)qualifies as a

Q36: Daniel purchases 5-year class listed property (a

Q65: On June 1,2016,AZ Construction Corporation places a

Q80: Eduardo is a single taxpayer with a

Q82: Periodic capital recovery deductions for tax purposes

Q90: In July 2016,Harriet sells a stamp from

Q103: Which of the following must be classified

Q110: Why did Congress enact the at-risk rules?

Q133: Fillmore's net Section 1231 gains and losses