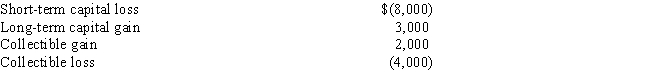

Serenity has the following capital gains and losses for the current year:

If Serenity is single and has taxable income from other sources of $75,000,what is the impact of her capital gains and losses on her income tax liability?

Definitions:

External Events

Occurrences outside of an individual's or organization's control that can have significant impacts on their actions, decisions, or performance.

Stoic

Pertaining to Stoicism, an ancient Greek philosophy that teaches virtue, wisdom, and endurance as the means to a tranquil and virtuous life.

Stoicism

Stoicism is an ancient philosophy that teaches the development of self-control and fortitude as a means of overcoming destructive emotions.

Onus

The responsibility or burden to prove something or to take action.

Q1: Direct purchase<br>A)Begins on the day after acquisition

Q2: The American Opportunity Scholarship Tax Credit provides

Q28: COMPREHENSIVE TAX RETURN PROBLEM.Your cousin,Antonia,who is 30

Q49: Limited Liability Partnership<br>A)An entity with conduit tax

Q65: On June 1,2016,AZ Construction Corporation places a

Q68: Canfield is single,70 years old,and has no

Q90: When a partner receives a cash distribution

Q98: Which income tax concepts/constructs might taxpayers who

Q124: For each of the following situations,determine whether

Q149: Which of the following individuals or couples