Multiple Choice

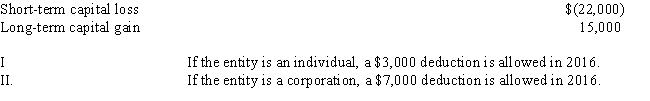

A taxable entity has the following capital gains and losses in 2016:

Definitions:

Related Questions

Q3: Howard is single and has a son

Q4: Julian and Judy divorced and Julian received

Q14: Which of the following properties from an

Q16: Mixed-use property<br>A)Land and structures permanently attached to

Q32: For each of the following situations,determine the

Q39: Dorchester purchased investment realty in 2001 for

Q66: Which of the following qualifies as a

Q72: Dana purchases an automobile for personal use

Q77: Dustin buys 200 shares of Monroe Corporation

Q138: Section 1231 assets include<br>A)Inventory.<br>B)Stocks and bonds.<br>C)Personal residence.<br>D)Business-use