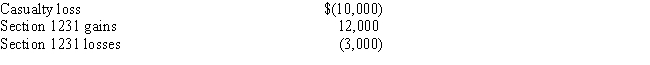

During 2016,Silverado Corporation has the following Section 1231 gains and losses:

During the period 2011 - 2015,the corporation recognized $8,000 of net Section 1231 losses as ordinary losses that have not been recaptured.How much of the 2016 Section 1231 gains and losses are recognized as long-term capital gains?

Definitions:

Economic Thinking

An approach to analyzing problems that considers the allocation of scarce resources and the trade-offs involved in decisions.

Additional Benefits

Extra advantages or positive outcomes that accompany a primary benefit or result.

Marginal Cost

The financial outlay required to produce an additional unit of a good or service.

Gasoline

A transparent, petroleum-derived liquid that is used primarily as a fuel in most spark-ignited internal combustion engines.

Q6: Henritta is the sole shareholder of Quaker

Q12: Sole proprietors are allowed to deduct owner-employee

Q36: Determine the proper classification(s)of the asset discussed

Q45: Rosen Group has a company health-care plan

Q63: Land held as an investment for an

Q74: Separate entity that never pays income taxes<br>A)Sole

Q76: Irene is 47 years old,unmarried,and has no

Q82: Norm acquired office equipment for his business

Q87: Under the computation of the alternative minimum

Q90: When a partner receives a cash distribution