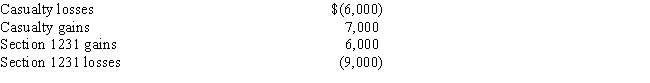

Davidson Corporation has the following gains and losses from Section 1231 property during 2016:

No net Section 1231 losses have been deducted as ordinary losses in prior years.How much of the 2016 Section 1231 gains and losses are recognized as long-term capital gains?

Definitions:

Changing Conditions

Variations or alterations in the environment, circumstances, or requirements that affect a situation or activity.

SWOT Analysis

A strategic planning tool used to identify Strengths, Weaknesses, Opportunities, and Threats related to business competition or project planning.

Core Competencies

refer to the unique strengths and abilities that a company or individual possesses, which give them a competitive advantage in the market.

Special Strengths

Unique abilities or talents that distinguish an individual or entity from others; often contributing significantly to success.

Q5: During 2016,Mercedes incorporates her accounting practice.Mercedes is

Q17: Nestor receives the right to acquire 1,000

Q24: When a security is sold at a

Q44: Marvin and Marshall own and operate MM

Q52: A sole proprietor<br>I.Can be an employee of

Q54: Which of the following statements are correct

Q56: Passive activity loss limitation rules do not

Q63: Contrast the facts and circumstances depreciation approach

Q66: Terry receives investment property from her mother

Q108: Louise makes the following contributions during the