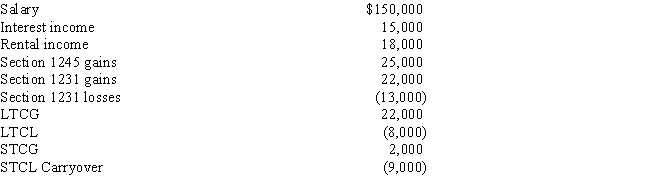

Warren's 2016 adjusted gross income consists of the following items:

Warren's combined §1231 gains and losses recognized over the prior five tax years included a net loss of $10,000.The STCL carryover arose from a loss reported in 2011.

What net amounts of ordinary income,LTCG income and STCG income will Warren's 2016 adjusted gross income consist of? (i.e.what amounts are reported after completing the netting process?)

Ordinary

Income LTCG STCG

Definitions:

Market Control

The ability of a single entity or a few entities to significantly influence the conditions or terms in a particular market.

Input Standards

Pre-defined criteria or benchmarks used to measure the quality, quantity, or timeliness of inputs in a production or manufacturing process.

Output Standards

Benchmarks set to measure the quantity, quality, or performance of a product or service produced.

Inferior Good

A type of good for which demand decreases as the income of consumers increases, opposite to a normal good.

Q5: Which of the following is (are)AMT tax

Q5: Ludwig died on April 5,2016.As part of

Q34: Tangible property<br>A)Land and structures permanently attached to

Q44: Which of the following statements pertaining to

Q44: All of the following are capital assets

Q62: Which of the following statements regarding a

Q70: Active participant<br>A)A loss that is generally not

Q78: Which of the following businesses must use

Q93: During the current year,Metcalf Corporation has the

Q147: Morris is a single individual who has