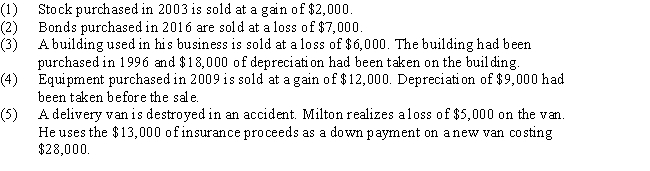

Milton has the following transactions related to his investments and his business during 2016:

a.Determine the amount and character of each gain or loss.

b.Determine the effect of the gains and losses on Milton's 2014 adjusted gross income. You must present the calculations in proper form to receive full credit.

Definitions:

James-Lange Theory

A theory of emotion suggesting that physiological arousal precedes the experience of emotion, thus emotions are the result of the interpretation of bodily responses.

Trembling

Involuntary shaking, quivering, or trembling movements, often resulting from fear, excitement, cold, or weakness.

Afraid

Experiencing fear or apprehension.

James-Lange Theory

A theory of emotion suggesting that physiological arousal precedes the experiencing of emotions.

Q11: The lookback recapture rule nets the current-year

Q25: Capital gain and loss planning strategies include<br>I.the

Q35: Kristin has AGI of $120,000 in 2015

Q58: Kobe receives a gift of rare books

Q67: Moses is a 20% partner in an

Q75: Unrecaptured Section 1250 gain is taxed at

Q78: Which of the following businesses must use

Q80: Eduardo is a single taxpayer with a

Q94: Buffey operates a delivery service.She purchased a

Q97: Why would a taxpayer ever elect to