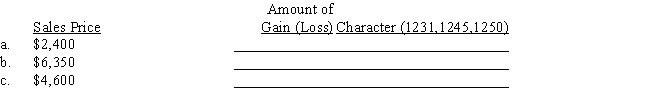

Maria acquired a personal computer to use 100% in her business for $6,000.She took MACRS deductions of $2,880 before selling it in current year.Determine the amount and character of the gain (loss)recognized on the sale of the computer,assuming a sales price that differs in each of the three independent situations:

Definitions:

Parental Monitoring

The strategies utilized by parents to oversee their children's activities, with the aim of protecting, guiding, and understanding their development and behavior.

Autonomy

The capacity to make an informed, uncoerced decision independently.

Dating Experience

The involvement in romantic or social activities with a potential or actual love interest.

Clique

A tightly knit peer group of about three to eight close friends who share similarities such as demographics and attitudes.

Q14: Hank realizes Section 1231 losses of $12,000

Q27: Kelly purchases a warehouse for her sole

Q30: Personalty<br>A)Land and structures permanently attached to land.<br>B)Property

Q35: Shannon purchases equipment classified as 3-year property

Q43: Under a qualified pension plan<br>I.The yearly earnings

Q43: When two qualified assets are exchanged and

Q77: Higlo Paints is a partnership that reports

Q86: Serena owns a van that she paid

Q92: Tim has a 25% interest in Hill

Q103: Commonalties of nonrecognition transactions include that<br>I.deferring a