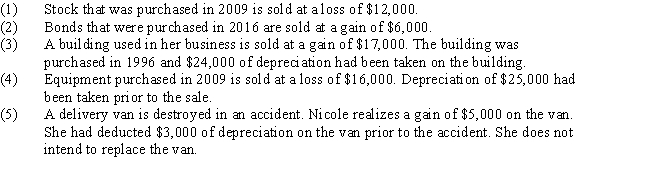

Nicole has the following transactions related to her investments and her sole proprietorship during 2016:

a.Determine the character of each gain or loss:

b.Determine the effect of the gains and losses on Nicole's current-year adjusted gross income.

Definitions:

Isocost Line

A diagram representing every possible mix of inputs that can be acquired for a specific total expenditure.

Cost Of Capital

The required return necessary to make a capital budgeting project, such as building a new factory, worthwhile.

Cost Of Labor

The total amount incurred by a business to compensate its employees, including wages, benefits, and taxes.

Cost Of Capital

The rate of return a company must earn on its project investments to maintain its market value and attract funds.

Q16: Cheryl purchased 500 shares of Qualified Small

Q34: Debra and Ken refinance their personal residence

Q44: Personal Service Corporations (PSCs)have certain special characteristics.Which

Q46: Which of the following is (are)secondary sources

Q49: Charlotte purchases a residence for $105,000 on

Q58: Toliver Corporation incurs a long-term capital loss

Q65: On June 1,2016,AZ Construction Corporation places a

Q100: Amortization<br>A)Computers, and automobiles.<br>B)Used to recover the investment

Q126: George's construction company completed 5 homes during

Q130: Elizabeth paid $400,000 for a warehouse.Using 39-year