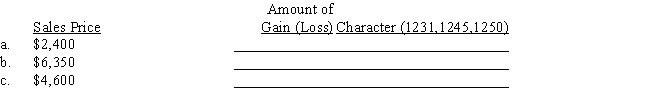

Maria acquired a personal computer to use 100% in her business for $6,000.She took MACRS deductions of $2,880 before selling it in current year.Determine the amount and character of the gain (loss)recognized on the sale of the computer,assuming a sales price that differs in each of the three independent situations:

Definitions:

Secure Attachment

A stable and healthy emotional bond between a child and their caregiver, characterized by trust and a sense of safety in the relationship.

Accommodation

In psychology, the cognitive process of revising existing cognitive schemas, perceptions, and understanding so that new information can be incorporated; in visual perception, the adjustment of the eye's lens to maintain a clear image.

Conservation

A cognitive development concept where children learn that properties like volume, mass, and number remain the same despite changes in the form of objects.

Egocentrism

The inability to differentiate between oneself and other people, often referring to a young child's understanding of the world.

Q18: If the U.S.Supreme Court denies a writ

Q27: Investment interest<br>A)Prepaid interest.<br>B)An amount that each taxpayer

Q39: On May 1,2015,Peyton is granted the right

Q49: George purchased a commercial building in 1999

Q51: Lane Inc.,an electing S corporation,realizes $150,000 from

Q54: Personal property consists of any property that

Q67: Byron is a partner in the Dowdy

Q83: Which of the following intangible assets is

Q88: Claudia owns 10% of the stock of

Q127: Kevin wants to know if he can