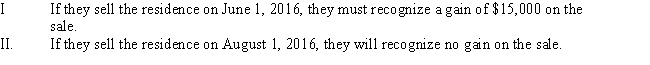

Charlotte purchases a residence for $105,000 on April 13,2004.On July 1,2014,she marries Howard and they use Charlotte's house as their principal residence.If they sell their home for $390,000,incurring $20,000 of selling expenses and purchase another residence costing $350,000.Which of the following statements is/are correct concerning the sale of their personal residence?

Definitions:

Red Shirts

Volunteers who followed the Italian patriot and general Giuseppe Garibaldi during his campaigns for the unification of Italy in the 19th century.

Giuseppe Garibaldi

An Italian general, patriot, and nationalist who played a key role in the unification of Italy, known for his leadership in the campaign and battles that consolidated different states of the Italian Peninsula into a single nation.

Piedmont-Sardinian Army

The military forces of the Kingdom of Piedmont-Sardinia, pivotal in the unification of Italy in the 19th century.

German Parliament

The legislative body in Germany, known as the Bundestag, responsible for passing laws and representing the German people.

Q1: Davis,Inc.,a motorcycle wheel manufacturer,purchased a new spoke

Q5: Which of the following is (are)AMT tax

Q10: The amount of the dividend on a

Q28: COMPREHENSIVE TAX RETURN PROBLEM.Your cousin,Antonia,who is 30

Q50: The mid-year convention under MACRS provides that<br>A)Depreciation

Q51: Section 1231 assets are certain trade or

Q62: Randall is given five acres of land

Q74: Wilshire Corporation purchased a commercial building in

Q75: Pension plans are subject to excess contribution

Q102: Sonya inherits 1,000 shares of Big Red