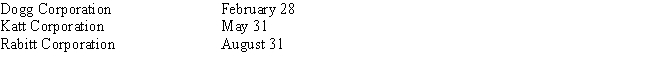

Dogg Corporation,Katt Corporation,and Rabitt Corporation are equal partners in Critter Partnership.The partner's fiscal year ends follow:  Which of the following statements is (are) correct?

Which of the following statements is (are) correct?

I.Critter Partnership may elect to use any of the three dates that the partners use.

II.Critter Partnership must use the tax year of the partner that creates the least amount of deferral.

Definitions:

Equality

The situation where individuals have the same rights, opportunities, and status.

Society's Resources

The total available assets, both natural and man-made, that are available for use by a society.

Marginal Benefit

The supplementary pleasure or utility a consumer experiences when an additional unit of a good or service is consumed.

Marginal Cost

The financial commitment needed to produce an additional unit of a product or service.

Q3: June is a 20% owner-employee in the

Q27: If the executor of a decedent's estate

Q30: A capital asset includes which of the

Q44: Marvin and Marshall own and operate MM

Q48: Hilliard receives a gift of stock from

Q51: Lane Inc.,an electing S corporation,realizes $150,000 from

Q55: Finance Committee<br>A)Where federal tax legislation generally originates.<br>B)Has

Q70: As a limited partner in Technonics,Ltd.,Dave is

Q71: Raymond,a single taxpayer,has taxable income of $155,000

Q100: Amortization<br>A)Computers, and automobiles.<br>B)Used to recover the investment