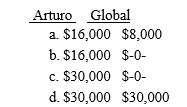

Global Corporation distributes property with a basis of $22,000 and a fair market value of $30,000 to Arturo in complete liquidation of the corporation.Arturo's basis in the stock is $14,000.What must Arturo and Global report as income upon the liquidation of Global?

Definitions:

Classical Conditioning

An educational technique involving the repeated pairing of two cues, resulting in a behavior initially prompted by the second cue being provoked by the first cue without the second.

Second-order Conditioning

A form of conditioning in which a stimulus that was previously neutral is paired with a conditioned stimulus to produce a similar conditioned response.

Stimulus Generalization

The process by which a conditioned response is triggered by stimuli that are similar but not identical to the original conditioned stimulus.

Behavior Environment Interactions

The dynamic and reciprocal relationship between an individual's behavior and the surrounding physical and social environment.

Q31: Fresh-start accounting must be adopted by certain

Q38: Discuss the type of property that is

Q42: The Rector Corporation maintains a SIMPLE-IRA retirement

Q47: Which of the following is not a

Q55: Which of the following items is not

Q56: Nontax characteristics that should be considered in

Q56: Passive activity loss limitation rules do not

Q71: Which of the following types of cases

Q109: All of the gain from the sale

Q111: Willie owns 115 acres of land with