Short Answer

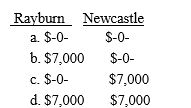

Rayburn owns all the shares of Newcastle Corporation that operates as an S corporation.Rayburn's basis in the stock is $15,000.During the year he receives a cash distribution of $22,000 from Newcastle.What must Rayburn and Newcastle report as income from the cash distribution?

Definitions:

Related Questions

Q8: Long-term capital gain classification is advantageous to

Q10: The amount of the dividend on a

Q12: Which of the following best describes the

Q22: Thelma can get the 10% penalty on

Q27: Which of the following is not a

Q55: Which of the following items is not

Q66: Louise is the marketing manager and a

Q71: Raymond,a single taxpayer,has taxable income of $155,000

Q84: The Tax Court strictly follows the precedent

Q119: Gains on the sale of certain types