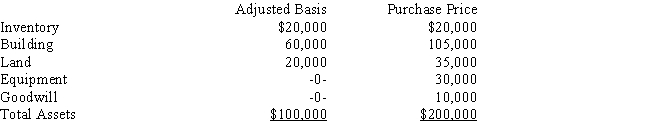

Dorothy operates a pet store as a sole proprietorship.During the year she sells the business to Florian for $200,000.The assets sold and the allocation of the purchase price are as follows:

Dorothy acquired the building in 1997 for $100,000 of which $20,000 was allocated to the land.She paid $40,000 for the equipment in the same year.What are the tax consequences of the liquidation for Dorothy?

Definitions:

Blood Clotting

The process that prevents excessive bleeding when the vascular system is injured, involving the transformation of blood from a liquid to a gel.

Incomplete Dominance

A condition in which neither member of a pair of contrasting alleles is completely expressed when the other is present.

Heterozygous

A genetic condition where an individual has two different alleles at a gene locus.

Intermediate Phenotype

A phenotype that represents a blend or a combination of two extreme phenotypic traits or forms found in a population.

Q14: The most important source of current federal

Q16: Any structure over 100 years old is

Q18: Under the equity method, the investor's share

Q30: Salem Inc.is an electing S corporation with

Q31: Which of the following has an asymmetric

Q33: Where should a university using fund accounting

Q44: The deferral of a gain realized on

Q49: The National Office of the IRS issues

Q53: Which of the following is not true

Q76: Rosilyn trades her old business-use car with