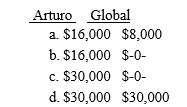

Global Corporation distributes property with a basis of $22,000 and a fair market value of $30,000 to Arturo in complete liquidation of the corporation.Arturo's basis in the stock is $14,000.What must Arturo and Global report as income upon the liquidation of Global?

Definitions:

Exchange Loss

A financial loss that occurs when the value of a currency decreases relative to another currency in transactions involving foreign exchange.

Year End

The end of the financial year for a company, marking the close of the reporting period.

Settlement Date

The date on which a trade is finalized, and the buyer must make payment and the seller must deliver the asset.

Exchange Rates

The rate at which one currency can be exchanged for another currency, impacting international trade and investment.

Q15: An option<br>A)is not traded on an organized

Q17: Kentucky Blue, Inc., a lawn care service

Q20: Limited Partnership<br>A)An entity with conduit tax characteristics

Q26: An exemption amount is allowed for the

Q38: Hogan, Inc.is a telecommunications company.Currently, Hogan is

Q55: Rand Company purchases and places into service

Q67: Byron is a partner in the Dowdy

Q69: The Great Gap University issues long-term debt

Q76: A U.S.formed multinational corporation<br>I.Can avoid the payment

Q79: Which of the following items are included