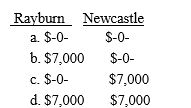

Rayburn owns all the shares of Newcastle Corporation that operates as an S corporation.Rayburn's basis in the stock is $15,000.During the year he receives a cash distribution of $22,000 from Newcastle.What must Rayburn and Newcastle report as income from the cash distribution?

Definitions:

Free Will

The concept that individuals have the power to make choices and decisions independently, without being predetermined by fate or divine will.

Determinism

The philosophical belief that all events, including human actions, are ultimately determined by causes external to the will.

Cognitive Processes

Mental activities involved in the acquisition, storage, manipulation, and retrieval of knowledge.

Modeling Therapy

A therapeutic technique involving learning through the observation and replication of others.

Q10: Land is depreciated typically on a ten-year

Q17: Carrie owns a business building with an

Q18: Sandi and Jodie are partners who operate

Q35: Shannon purchases equipment classified as 3-year property

Q39: Under special accounting treatment for cash flow

Q71: Raymond,a single taxpayer,has taxable income of $155,000

Q74: Rodrigo and Raquel are married with 2

Q88: Primary sources of tax law include<br>I.Treasury Regulations.<br>II.IRS

Q96: Which of the following is not a

Q133: Fillmore's net Section 1231 gains and losses