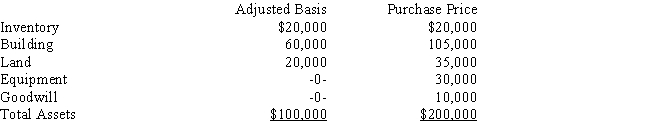

Dorothy operates a pet store as a sole proprietorship.During the year she sells the business to Florian for $200,000.The assets sold and the allocation of the purchase price are as follows:

Dorothy acquired the building in 1997 for $100,000 of which $20,000 was allocated to the land.She paid $40,000 for the equipment in the same year.What are the tax consequences of the liquidation for Dorothy?

Definitions:

Online Course

An educational course offered entirely over the internet, allowing students to learn remotely.

Sample Size

The quantity of subjects or units selected from a population to participate in a research study, determining the study's ability to detect a significant effect.

T Procedure

A statistical method typically used to test hypotheses when the sample size is small and the population variance is unknown, involving the t-distribution.

Approximately Normal

Describes a distribution that closely follows a normal distribution, often used as an assumption in statistical tests.

Q6: During the legislative process,several groups of lawmakers

Q10: Land is depreciated typically on a ten-year

Q15: Laurie and Lodi are dentists who have

Q16: The marital deduction is allowed for the

Q23: Unrecaptured Section 1250 gain<br>I.applies to real property

Q25: Mike purchases a computer (5-year property)for $3,000

Q44: All of the following are capital assets

Q50: Courtney and Nikki each own investment realty

Q67: Byron is a partner in the Dowdy

Q69: Leonor is the financial vice-president and owns