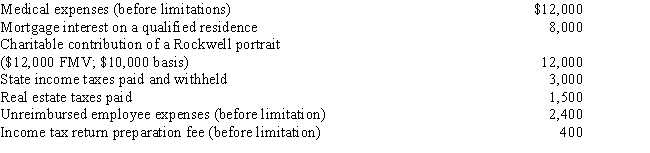

Eileen is a single individual with no dependents.Her adjusted gross income for 2016 is $60,000.She has the following items that qualify as itemized deductions.What is the amount of Eileen's AMT adjustment for itemized deductions for 2016?

Definitions:

Contract Rejection

Refers to a party's refusal to accept or acknowledge a contractual agreement, leading to termination or renegotiation.

Arbitrator

An arbitrator is a neutral third party who is appointed to resolve a dispute between two or more parties outside of the court system.

Union Members

Individuals who belong to a labor union, an organization that represents the collective interests of workers in negotiations with employers.

Management

The process of directing, controlling, and overseeing the operations and tasks of a business or organization.

Q4: In the accounting statement of affairs, the

Q17: Virginia is the sole shareholder in Barnes

Q29: Jane receives a nonliquidating distribution of land

Q29: On September 1st of the current year,

Q38: Hogan, Inc.is a telecommunications company.Currently, Hogan is

Q45: On May 11, McElroy Inc.purchased a call

Q60: Harry sells an apartment building for $117,000.The

Q73: Tax statute<br>A)Tax Court Reports<br>B)United States Tax Cases<br>C)Internal

Q80: Matt has a substantial portfolio of securities.As

Q96: Which of the following is not a