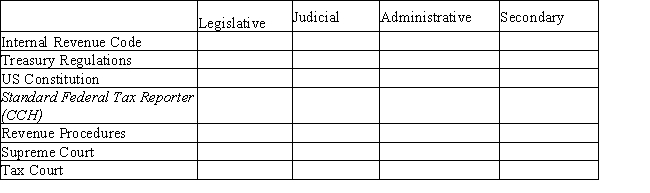

This problem requires determining the type of tax law authority and the relative importance within that authority category.Indicate "1" for the highest-ranking item within each category.Indicate "2" for the next-highest ranking item within each category.Each column may have zero,one,or more items ranked.

Definitions:

Privity

The relationship between parties that are legally participating in the same transaction or agreement.

Accountant Negligence

A situation where an accountant fails to perform their duties with the required level of care and accuracy, leading to financial loss.

Professional Standards

The established practices, behavior, and ethical guidelines that professionals are expected to adhere to in their occupation.

Liability Threat

A potential for being held responsible under law for injury or damage, posing a risk to individuals or organizations.

Q13: On January 5,2016,Mike acquires a 50% interest

Q21: A public university's long-term bonds issued to

Q72: Which of the following entities can provide

Q75: Joint Conference Committee<br>A)Where federal tax legislation generally

Q82: Which of the following is/are correct with

Q86: Which of the following is (are)secondary sources

Q87: Marty owns 30% of the stock of

Q91: Karl is scheduled to receive an annuity

Q98: Rosilyn trades her old business-use luxury car

Q109: Inventory for office supplies.<br>A)qualifies as a like-kind