Consider the following:

?

?

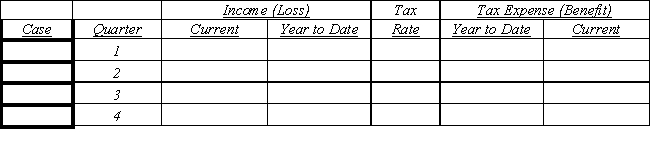

Case Income (loss) for quarters 1 through 4 is , and , respectively. Future projected income for the year is uncertain at the end of quarters 1 and 2. Annual income at the end of quarter 3 is estimated to be . No carryback benefit exists, and any future annual benefit is uncertain.

Case B Assume the same facts as in Case A. However, at the end of quarters 1 through 3 , annual income is estimated to be .

Case C Quarterly income (loss) levels were , ( , and . A yearly operating loss of was anticipated throughout the year. Frior years' income of is avail able for carryback. The same tax rates were relevant to the carryback period Required:

?

For cases A through C, complete the schedule that follows: Assume that the statutory tax rate is 15% on the first $50,000 of income, 25% on the next $25,000, and 30% on income in excess of $75,000.

?

Definitions:

Marginal Probability

The probability of an occurrence of a single event without consideration of any other events.

Coefficient of Correlation

A quantitative gauge assessing the force and trajectory of a linear linkage between a pair of elements.

Covariance

A measure that indicates the degree to which two variables change together, showing if increases in one variable tend to be associated with increases or decreases in the other.

Marginal Probability

The probability of an event occurring, taken in isolation, without consideration of any other related events.

Q3: Scott Inc.expects to have financial income

Q11: Patten Company purchased an 80% interest in

Q17: Paton Company has an $11,000,000, note

Q20: After eliminating the deficit in a reorganization

Q25: On February 1, 2014, Sharon Kane died.Sharon

Q26: On January 1, 2016, Payne Corp.purchased 70%

Q29: Because good will is amortized over 15

Q38: The main difference between an agency fund

Q43: Which of the following would fall under

Q49: On November 1, 20X8 Desket, Inc.a