In January, 2016, Dudwil Corporation acquired a foreign subsidiary, Holman Company, by paying cash for all of the outstanding common stock of Holman.On the purchase date, Holman Company's accounts were stated fairly in local currency units (FC).Subsequent sales of Holman's common stock have been purchased by Dudwil to maintain its 100% ownership.

?

Holman's trial balance, in functional currency units (same as the local currency units), on December 31, 2022, follows:

?

?

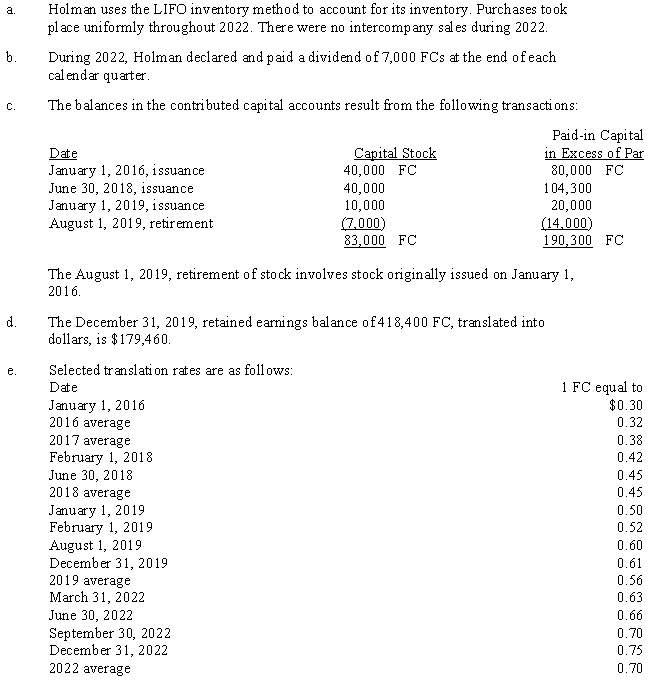

The following additional information is available:

?

?

Required:

Required:

?

Prepare a schedule to translate the December 31, 2022, trial balance of Holman Company from local currency units to dollars.The schedule should show the trial balance in FCs, the exchange rates, and the trial balance.(Do not extend the trial balance to statement columns.Supporting schedules should be in good form.)

Definitions:

Antiarrhythmic

A type of medication used to treat irregular heartbeats or arrhythmias.

Cardiac Electrical Rhythm

The pattern of electrical activity in the heart that triggers its contractions, essential for maintaining an effective heartbeat.

Chemical Activity

Relates to the rate at which a chemical substance undergoes a reaction, typically influenced by conditions like temperature and pressure.

Hemostatic

Pertaining to the stopping or controlling of bleeding.

Q7: Assume a budget for City has been

Q8: Reciprocal interfund activities include interfund services between

Q11: Discuss the conditions under which the SEC

Q13: Powell Company owns an 80% interest in

Q15: Recently revised accounting standards for mergers and

Q18: Pinehollow acquired 70% of the outstanding

Q28: Which of the following would not be

Q33: Parent has purchased additional shares of subsidiary

Q38: The main difference between an agency fund

Q61: Currently, which organization has jurisdiction over accounting