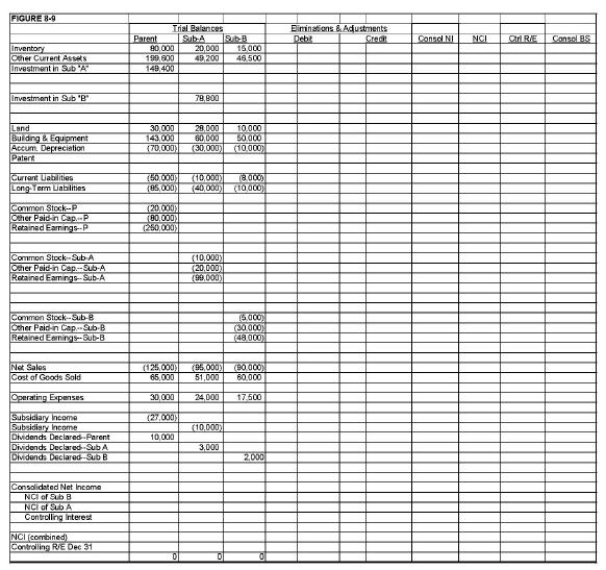

On January 1, 2016, Parent Company purchased 90% of the common stock of Sub-A Company for $90,000.On this date, Sub-A had common stock, other paid-in capital, and retained earnings of $10,000, $20,000, and $60,000 respectively.

On January 1, 2017, Sub-A Company purchased 80% of the common stock of Sub-B Company for $64,000.On this date, Sub-B Company had common stock, other paid-in capital, and retained earnings of $5,000, $30,000, and $40,000 respectively.

Any excess of cost over book value on either purchase is due to a patent, to be amortized over ten years.

Both Parent and Sub-A have accounted for their investments using the simple equity method.

During 2017, Sub-B sold merchandise to Sub-A for $20,000, of which one-fourth is still held by Sub-B on December 31, 2017.Sub-B's usual gross profit is 40%.During 2018, Sub-B sold more goods to Sub-A for $30,000, of which $10,000 is still on hand on December 31, 2018.

Required:

Complete the Figure 8-9 worksheet for consolidated financial statements for 2018.

Definitions:

Genes

Biological units of heredity located in DNA; responsible for passing genetic information from parents to offspring, determining individual characteristics.

Identical Twins

Another term for monozygotic twins, highlighting their shared genetic origin and identical genetic makeup.

Infant Mortality

The death of children under the age of one year, often measured as the number of deaths per 1000 live births in a given region or period.

Friendships

Social connections between individuals that involve mutual affection, support, and bonds beyond simple acquaintanceship.

Q1: What strike of the early 21st Century

Q4: Polk issues common stock to acquire all

Q11: A parent company purchased all the

Q16: John Dunlop espoused which of the following

Q18: Company P purchased an 80% interest in

Q20: Currently, which of the following has jurisdiction

Q27: The Management Discussion and Analysis gives a

Q28: On January 1, 2016, Patrick Company

Q46: What is the percentage of the unionized

Q48: In a Debt Service fund:<br>A)expenditures for interest