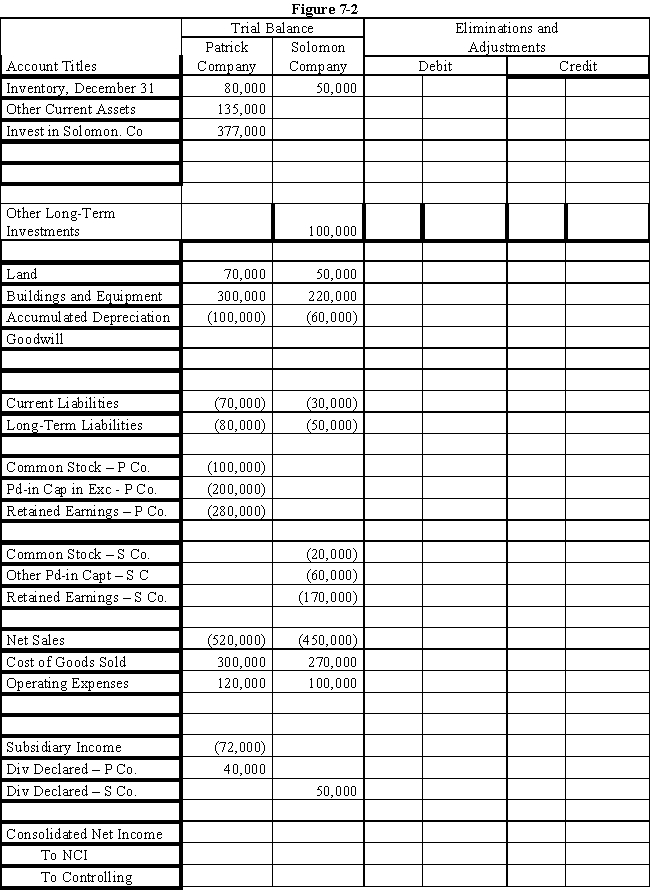

On January 1, 2016, Patrick Company purchased 60% of the common stock of Solomon Company for $180,000.On this date, Solomon had common stock, other paid-in capital, and retained earnings of $20,000, $60,000, and $120,000 respectively.

?

On January 1, 2016, the only tangible asset of Solomon that was undervalued was land, which was worth $15,000 more than book value.

?

On January 1, 2017, Patrick Company purchased an additional 30% of the common stock of Solomon Company for $140,000.

?

Net income and dividends for 2 years for Solomon Company were:

?

?

In the last quarter of 2017, Solomon sold $80,000 of goods to Patrick, at a gross profit rate of 30%.On December 31, 2017, $20,000 of these goods are in Patrick's ending inventory.In both 2016 and 2017, Patrick has accounted for its investment in Solomon using the simple equity method.

?

Required:

?

a.Using the information from the scenario or on the separate worksheet, prepare necessary determination and distribution of excess schedules for the two purchases.?

?

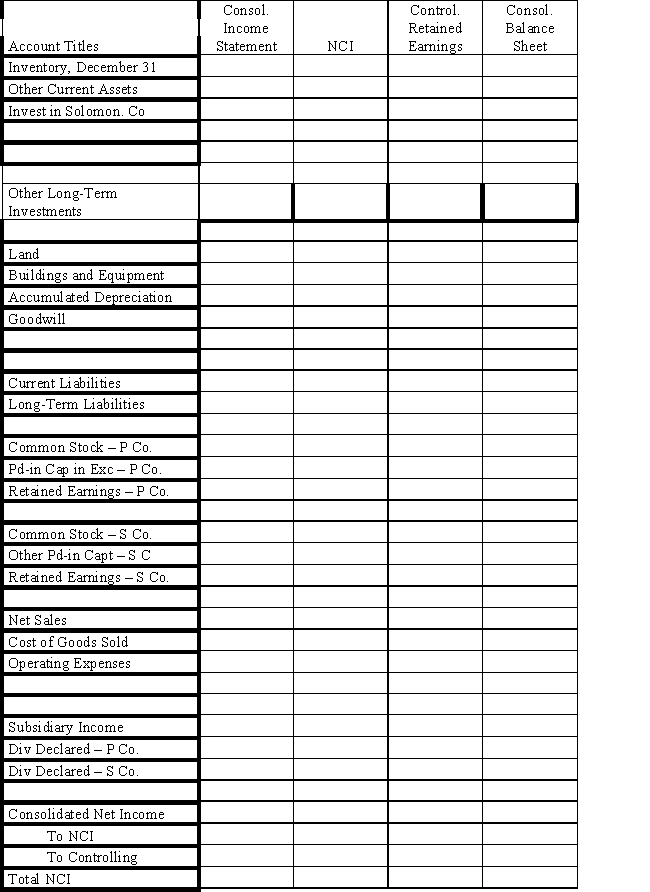

b.Complete the Figure 7-2 worksheet for consolidated financial statements for 2017.?

?

?

?

Definitions:

Blood

A vital fluid in humans and animals that delivers necessary nutrients and oxygen to the cells and carries away waste products.

Mother

A female parent of a child or offspring.

Baby

A very young child, especially one newly or recently born.

Teratogen

An agent or factor that causes malformation of an embryo.

Q7: Balance sheet information for Pawn Company

Q7: Describe the complexities stemming from U.S.-based companies

Q8: Describe the three types of general ledger

Q9: The Single Audit Act requires that a

Q15: A U.S.manufacturer has sold goods to

Q23: On January 1, 2016, Parent Company

Q23: In performing the impairment test for

Q33: Ansfield, Inc.has several potentially reportable segments.The

Q33: What may ultimately reduce the percentage of

Q46: Santas Corporation is a diversified firm with