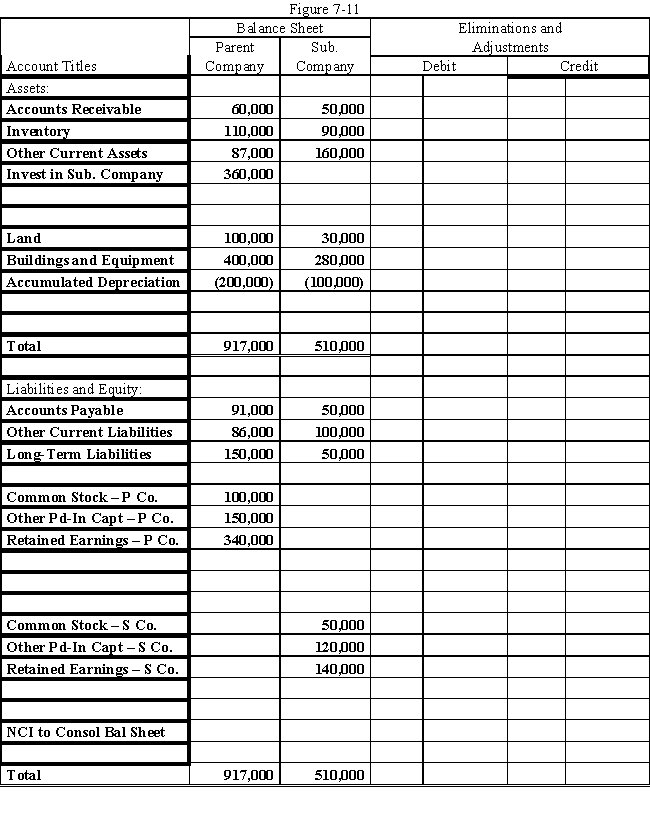

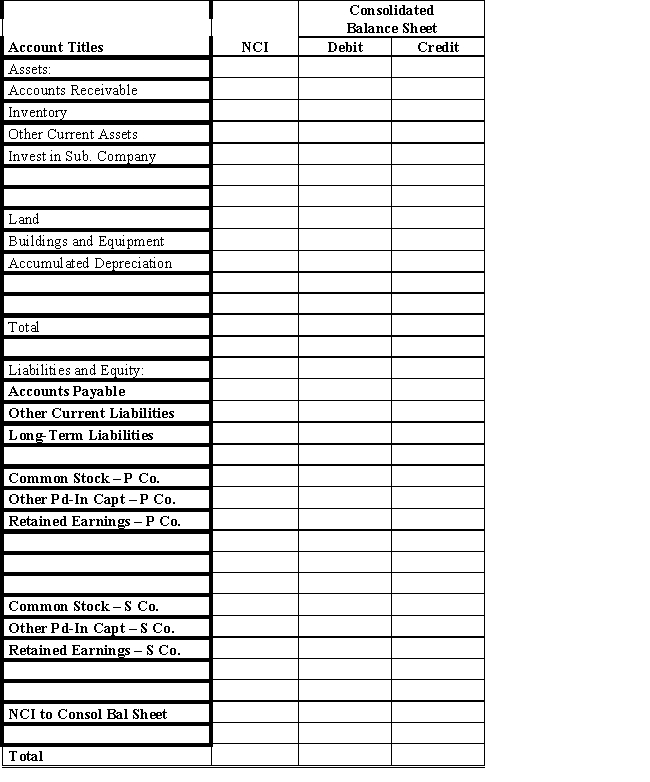

On January 1, 2016, Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000.On this date, Subsidiary had total owners' equity of $270,000, including retained earnings of $100,000.

?

On January 1, 2016, any excess of cost over book value is attributable to the undervaluation of land, building, and goodwill.Land is worth $20,000 more than cost.Building is worth $60,000 more than book value.It has a remaining useful life of 6 years and is depreciated using the straight-line method.

?

During 2016, Parent has accounted for its investment in Subsidiary using the cost method.

?

During 2016, Subsidiary sold merchandise to Parent for $70,000, of which $20,000 is held by Parent on December 31, 2016.Subsidiary's usual gross profit on affiliated sales is 50%.

?

On December 31, 2016, Parent still owes Subsidiary $5,000 for merchandise acquired in December.

?

On July 1, 2016, Parent sold to Subsidiary some equipment with a cost of $40,000 and a book value of $18,000.The sales price was $30,000.Subsidiary is depreciating the equipment over a 4-year life, assuming no salvage value and using the straight-line method.

?

Required:

?

Prepare a determination and distribution of excess schedule.Next, complete the Figure 7-11 worksheet for a consolidated balance sheet as of December 31, 2016.

?

Definitions:

Credit Card

is a plastic card issued by a bank or financial institution allowing the holder to purchase goods or services on credit.

Date

A specific day of the month or year, often specified by a number.

Envy

is an emotion characterized by feeling discontent or covetousness towards another's advantages, achievements, or possessions.

BMW

A German multinational corporation known for producing luxury vehicles and motorcycles, recognized for its performance, innovation, and design.

Q6: A reconciliation of the revenue, profit and

Q6: The partnership of X,Y, Z was

Q10: Pete purchased 100% of the common

Q11: Unlike many labour organizations, the ILO is

Q17: On January 1, 2016, Rabb Corp.purchased 80%

Q18: Company P purchased an 80% interest in

Q21: Until 1872, unions were considered to be

Q24: Pesto Company paid $8 per share to

Q24: Discuss the merits of accounting for subsidiaries

Q73: Gains and losses resulting from a derivative