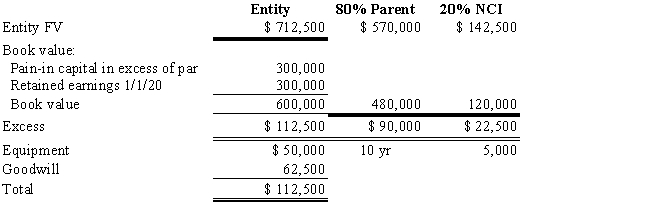

Company S has been an 80%-owned subsidiary of Company P since January 1, 2018.The determination and distribution of excess schedule prepared at the time of purchase was as follows:

?

?

On January 2, 2019, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000.No excess resulted from this transaction.Alpha earned $100,000 net income during 2019 and paid $20,000 in dividends.

On January 2, 2019, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000.No excess resulted from this transaction.Alpha earned $100,000 net income during 2019 and paid $20,000 in dividends.

?

The only change in plant assets during 2019 was that Company S sold a machine for $10,000.The machine had a cost of $60,000 and accumulated depreciation of $40,000.Depreciation expense recorded during 2019 was as follows:

?

?

The 2019 consolidated income was $180,000, of which the NCI was $10,000.Company P paid dividends of $12,000, and Company S paid dividends of $10,000.

?

Consolidated inventory was $287,000 in 2018 and $223,000 in 2019; consolidated current liabilities were $246,000 in 2018 and $216,700 in 2019.Cash increased by $203,700.

?

Required:

?

Using the indirect method and the information provided, prepare the 2019 consolidated statement of cash flows for Company P.and its subsidiary, Company S.

Definitions:

Operating Leverage

The ratio of fixed costs to total costs. The higher a firm’s operating leverage, the greater will be the variability of profits for a given change in sales.

Income Tax

A tax levied by governments on individuals or entities based on their income or profits.

Reward System

Programs and strategies to recognize and compensate employees for their performance and contribution to the organization.

Performance Measures

Metrics used to evaluate the efficiency, effectiveness, and performance of an organization's activities or employees.

Q1: On 6/1/17, an American firm purchased

Q7: O & P form a partnership on

Q7: Assume a budget for City has been

Q15: Abitz Corporation has the following pretax

Q16: Which of the following is not true

Q21: On January 1, 2016, a U.S.firm bought

Q24: The reconciliation of the annual translation adjustment

Q24: A large nation-wide bank's acquisition of a

Q27: Donations of capital assets are not recognized

Q33: If a US.parent loans funds on a