On January 1, 2016 Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000.On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively.Any excess of cost over book value is due to goodwill.Parent accounts for the Investment in Subsidiary using the simple equity method.

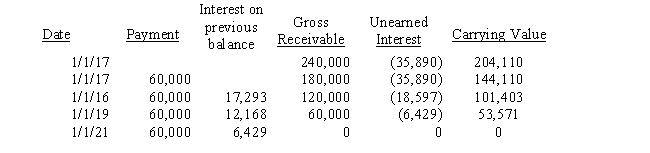

On January 1, 2017, Parent purchased equipment for $204,110 and immediately leased the equipment to Subsidiary on a 4-year lease.The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments.The implicit interest rate is 12%.The lease provides for an automatic transfer of title at the end of 4 years.The estimated useful life of the equipment is 6 years.The lease has been capitalized by both companies.The lease amortization schedule is presented below:

Required:

Required:

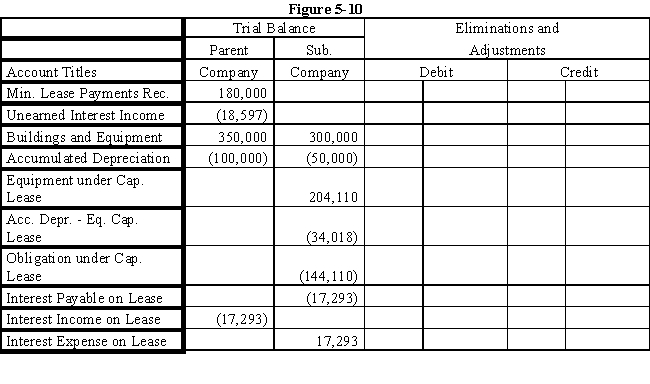

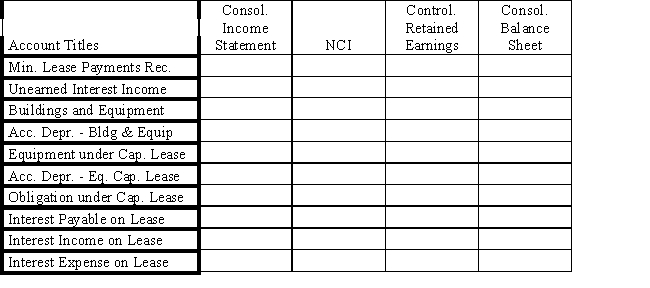

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-10 partial worksheet as of December 31, 2017.Key and explain all eliminations and adjustments.

Definitions:

Contra Stockholders' Equity

Accounts on a company's balance sheet that have a negative balance, reducing the overall equity of stockholders.

Retained Earnings

The portion of net profits not paid out as dividends but retained by the company to be reinvested in its core business or to pay debt.

Paid-In Capital

The amount of capital "paid in" by investors during common or preferred stock issuances, including the par value of the shares themselves plus any additional paid-in capital.

Treasury Stock

Stocks that the original issuing company has repurchased, decreasing the total number of shares available for trade in the public market.

Q4: Pease Corporation owns 100% of Sade

Q4: Company P purchased an 80% interest

Q5: On January 1, 2016, Rapid Corporation

Q9: Although the admission of new partner does

Q14: Poplar Corp.acquires the net assets of

Q29: Jones Company acquired Jackson Company for $2,000,000

Q39: Canada's reliance on international trade makes the

Q42: Larson, Inc.sold merchandise for 600,000 FC

Q43: Which of the following is not an

Q46: What is the most common reason why