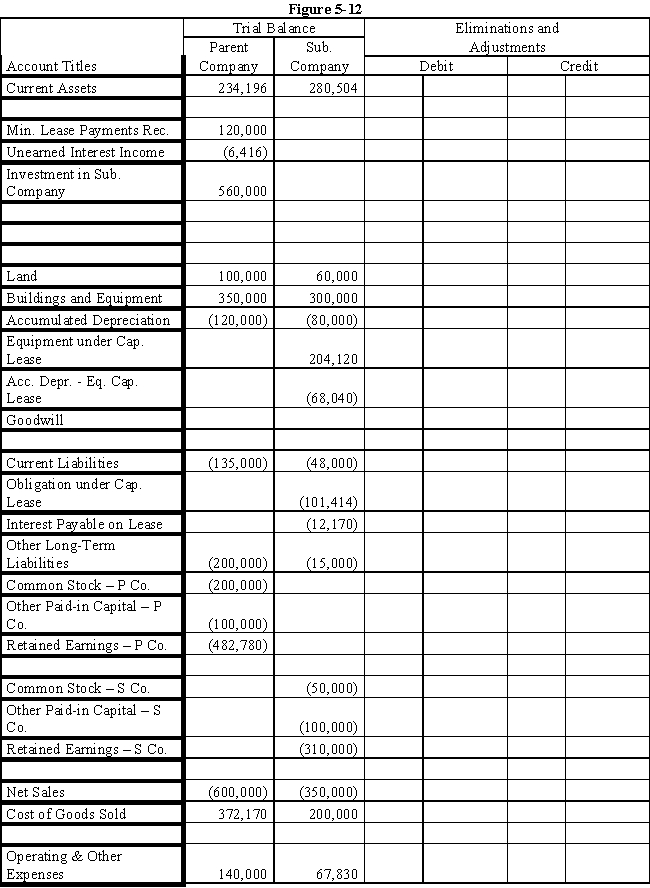

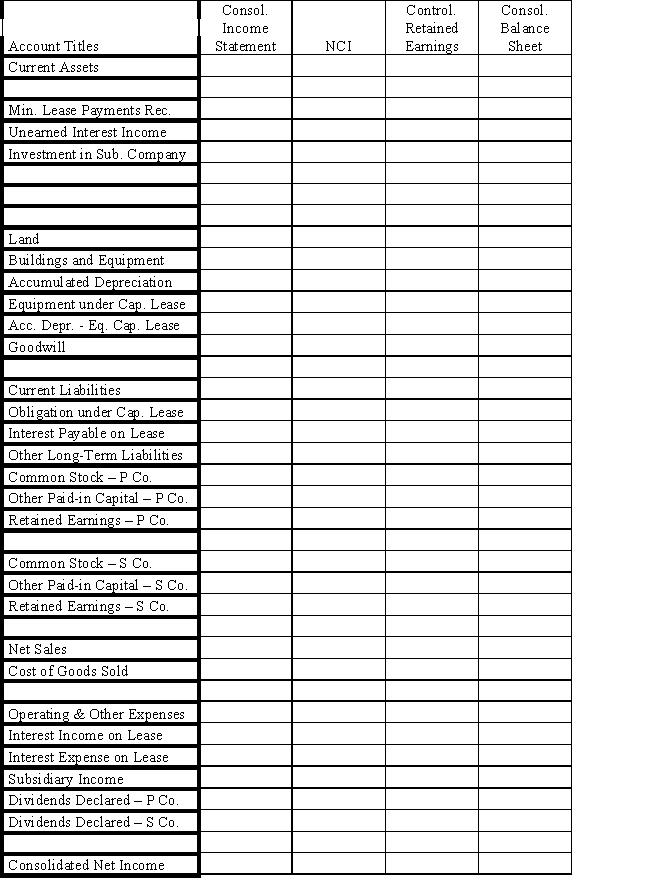

On January 1, 2016, Parent Company purchased 100% of the common stock of Subsidiary Company for $390,000.On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively.Any excess of cost over book value is due to goodwill.Parent accounts for the Investment in Subsidiary using the simple equity method.

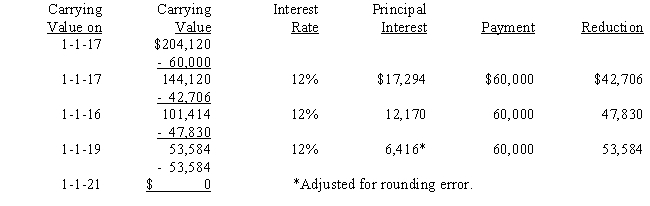

On January 1, 2017, Parent purchased equipment for $204,120 and immediately leased the equipment to Subsidiary on a 4-year lease.The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments.The implicit interest rate is 12%.The lease provides for an automatic transfer of title at the end of 4 years.The estimated useful life of the equipment is 6 years.The lease has been capitalized by both companies.

A lease amortization schedule, applicable to either company, is presented below:

On January 1, 2016, Parent held merchandise acquired from Subsidiary for $10,000.During 2016, subsidiary sold merchandise to Parent for $50,000, of which $15,000 is held by Parent on December 31, 2016.Subsidiary's usual gross profit on affiliated sales is 40%.

On January 1, 2016, Parent held merchandise acquired from Subsidiary for $10,000.During 2016, subsidiary sold merchandise to Parent for $50,000, of which $15,000 is held by Parent on December 31, 2016.Subsidiary's usual gross profit on affiliated sales is 40%.

Required:

Complete the Figure 5-12 worksheet for consolidated financial statements for the year ended December 31, 2016.Round all computations to the nearest dollar.

Definitions:

Administrative Leadership

Focuses on managing operations, processes, and systems within an organization to ensure efficiency and effectiveness.

Alignment

The process of adjusting elements in a line or bringing them into a proper orientation or agreement.

Control

The set of mechanisms used to keep actions and outputs within predetermined limits.

Relation-Oriented

Describes leadership or management styles that prioritize and emphasize building strong, positive relationships among team members and stakeholders.

Q2: Success within the guild required all but

Q8: Goodwill results when:<br>A)a controlling interest is acquired.<br>B)the

Q13: An environmental distinction between a business enterprise

Q16: Balance sheet information for Pawn Company

Q22: Record the following journal entries:<br>?<br>Vouchers were approved

Q27: The 1982 Dolphin Delivery case dealt with<br>A)

Q43: Which of the following statements is not

Q46: A, B and C have a

Q50: Futura Corporation reported pretax net income of

Q55: What is meant by the term 'systemic