On January 1, 2016 Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000.On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively.Any excess of cost over book value is due to goodwill.Parent accounts for the Investment in Subsidiary using the simple equity method.

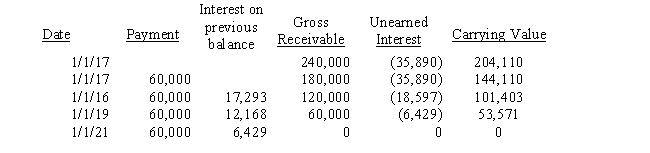

On January 1, 2017, Parent purchased equipment for $204,110 and immediately leased the equipment to Subsidiary on a 4-year lease.The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments.The implicit interest rate is 12%.The lease provides for an automatic transfer of title at the end of 4 years.The estimated useful life of the equipment is 6 years.The lease has been capitalized by both companies.The lease amortization schedule is presented below:

Required:

Required:

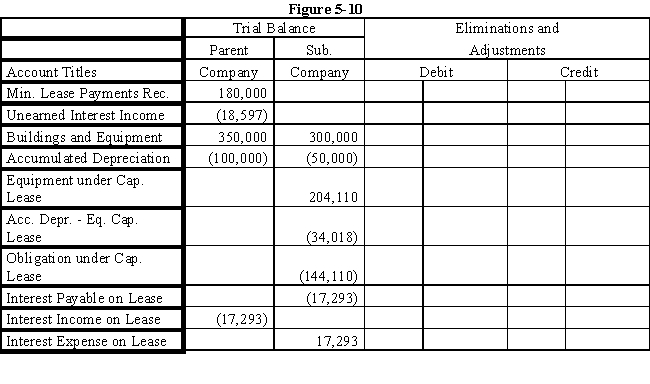

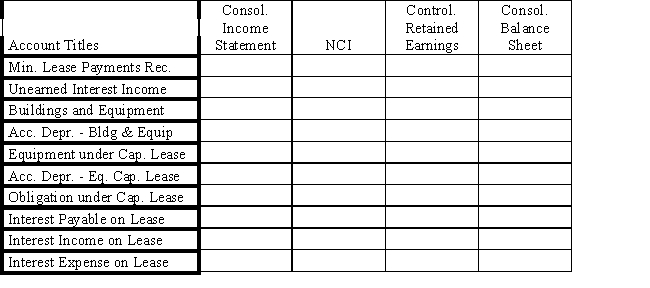

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-10 partial worksheet as of December 31, 2017.Key and explain all eliminations and adjustments.

Definitions:

High-Speed Internet

Broadband internet service that offers significantly faster data download and upload speeds compared to traditional dial-up.

Literacy Skills

The abilities required to read, write, and communicate effectively, enabling an individual to function and contribute to society.

News Aggregators

Websites or software applications that collect and organize web content from different sources for easy viewing.

Google News

A news aggregator service developed by Google that presents a continuous, customizable flow of articles organized from thousands of publishers and magazines.

Q7: Which of the following is not a

Q13: Pepper Company owned 60,000 of Salt

Q25: A building materials company's acquisition of a

Q42: A(n) _ occurs when the management of

Q44: On November 1, 2016, a U.S.company

Q44: On January 1, 2016 the fair

Q46: A forward exchange contract is being transacted

Q46: The purchase of outstanding subsidiary bonds by

Q59: Explain the difference in the independent and

Q60: Lancaster Inc.expects to have taxable income