On January 1, 2016, Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000.On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively.Any excess of cost over book value is due to goodwill.Parent uses the simple equity method to account for its investment in subsidiary.

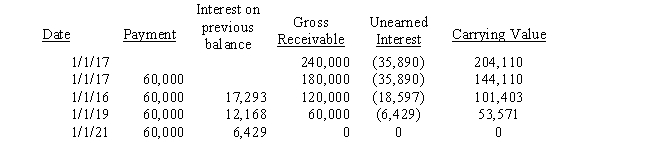

On January 1, 2017, Parent purchased equipment for $204,110 and immediately leased the equipment to Subsidiary on a 4-year lease.The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments.The implicit interest rate is 12%.The lease provides for an automatic transfer of title at the end of 4 years.The estimated useful life of the equipment is 6 years.The lease has been capitalized by both companies.A lease amortization schedule, applicable to either company, is presented below:

Required:

Required:

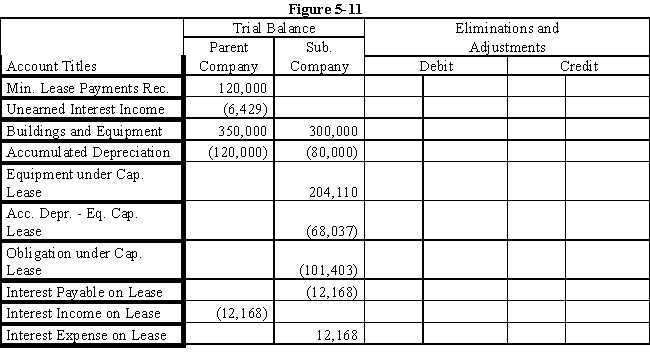

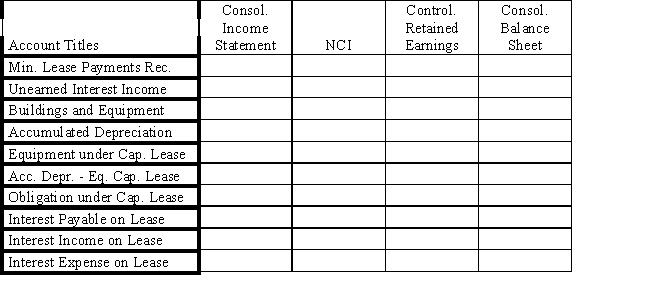

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-11 partial worksheet as of December 31, 2016.Key and explain all eliminations and adjustments.

Definitions:

Product Life Cycles

The stages a product goes through from development and introduction to growth, maturity, and decline in the market.

Introduction Stage

The initial phase in a product's lifecycle, characterized by low sales and often resulting in losses.

Strategic Leadership

The ability to influence others towards the achievement of long-term organizational goals through strategic vision and action.

Liverworts

A group of non-vascular plants belonging to the division Marchantiophyta, characterized by flat green thalli and often found in moist, shady environments.

Q1: Foreign firms operating in highly inflationary economies

Q1: On January 1, 2016, Promo, Inc.purchased

Q5: Public sector labour legislation does all of

Q10: Michael, Angel, and Lou are partners and

Q13: During the Winnipeg General Strike of 1919,

Q17: The entity theory of partnership conceptually suggests

Q19: List at least three of the important

Q21: Until 1872, unions were considered to be

Q27: Robbins Corporation has a wholly-owned foreign

Q38: An investor records its share of its